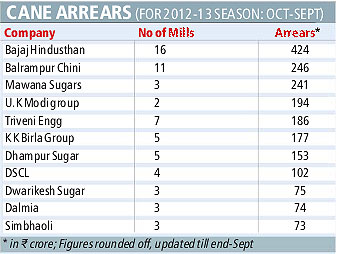

UP sugar mills run 'ponzi scheme' to pay farmers' dues

On the surface, the sugar crisis in Uttar Pradesh may seem to be inching closer to a resolution. But cane farmers may have unwittingly mortgaged their land, signing up for crop loans from public sector banks, with the money so raised being used by the mills to pay arrears of a different set of farmers.

This model, of mills rotating working capital loans from banks, to deliver pending payouts to farmers has reportedly been on for the last several cane crop seasons.

In Uttar Pradesh’s sugar industry , the biggest industry in the state, the crop loans concept has been twisted to suit the interest of three interest groups in the value chain — the cane farmer, the crushing mills and PSU banks.

Under this, mills, acting as agents or intermediaries for PSU banks, borrow money on a particular farmer’s account to buy inputs such as seeds or fertiliser for the next year’s crop but the money is actually paid to a different farmer to clear overdue cane payments.

“It is akin to a ponzi scheme,” said the owner of a large sugar company, who did not wish to be identified, but admitted to a practice that has been rife in the organised sugar industry over the last couple of years. If banks refuse to provide loans this season, and mills are unable to raise funds, the ponzi scheme will be exposed with many farmers’ land remaining mortgaged with the banks.

The trigger for an impending implosion comes from two factors — one, banks have declined to provide higher working capital loans to the sugar industry this season and two, there is uncertainty over how much of the season’s produce will go for crushing.

The arrangement is on the verge of unravelling because a big sugar company has already cried foul and has sounded out not only the banks but also the UP administration and the Union agricultural ministry. Almost all big sugar companies are party to such mortgage arrangements of farmers’ land to raise money.

Tanay Tapas

PGDM 1st

Thanks for sharing.This is nice and helpful post.

ReplyDeleteSprocket