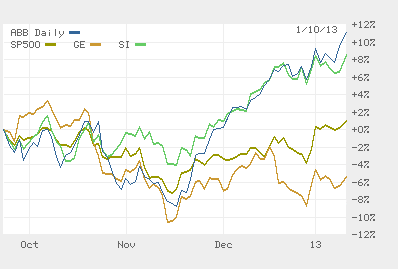

ABB’s stable performance priced into valuation

ABB India Ltd’s

recovery in order inflows and profitability for the March quarter may

stand out on the global map. Even though it comprises a minuscule

portion of global business, the India-listed entity posted a 29% growth

in order inflows and about 1.47 percentage point rise in operating

margin compared with a year ago. But revenue and profit growth was

marginally below Bloomberg’s consensus estimates.

For capital goods companies, new orders is the star that guides

future revenue and profit growth. New order growth beat the growth rates

in other Asian regions including China. ABB

India’s statement says it got large orders for transformers,

substations and medium voltage drives. However, the quarter posted a 4%

drop in order backlog. Meanwhile, only a pick-up in the infrastructure

sector’s capital expenditure cycle will improve the situation, which

remains challenging.

The highlight for the quarter was the 6.9% operating

margin—higher compared with the year-ago period and the preceding

quarter. Profitability improved as a result of strategic cost-savings

initiatives and a huge cost-saving on raw materials. Hence, operating

profit expanded by around 18% to Rs.126 crore in spite of a 7% contraction in net revenue to Rs.1,982 crore.

In line with the parent company’s performance, ABB India

was able to offset cost pressures and delays in long-gestation, large

orders with short-cycle projects that fared well. The same trend has

been seen in the March quarter results of most capital goods makers.

In its March quarter results presentation, the Swiss

parent said that negative volumes plus higher sales and research and

development expenses have weighed on margins at the global level. But

what matters is that the profit margin has improved across most critical

divisions both for the parent and the domestic company.

ABB India’s net profit jumped by nearly 22% year-on-year to Rs.52

crore, again slightly lower than forecast. The capital goods maker is

trying to focus on profitability through difficult times. Fitch Ratings Inc. upgraded ABB India’s ratings, citing improved business profile, cost savings, and healthy and free cash flows.

Yet, from an investor’s standpoint, ABB India’s market price of Rs.823.85

prices in all the positives. Any strong upsides in stock price will

come from large order inflows and receding economic headwinds. Until

then, leading brokerages reckon there would be no scope for any earning

or valuation upgrades.

No comments:

Post a Comment